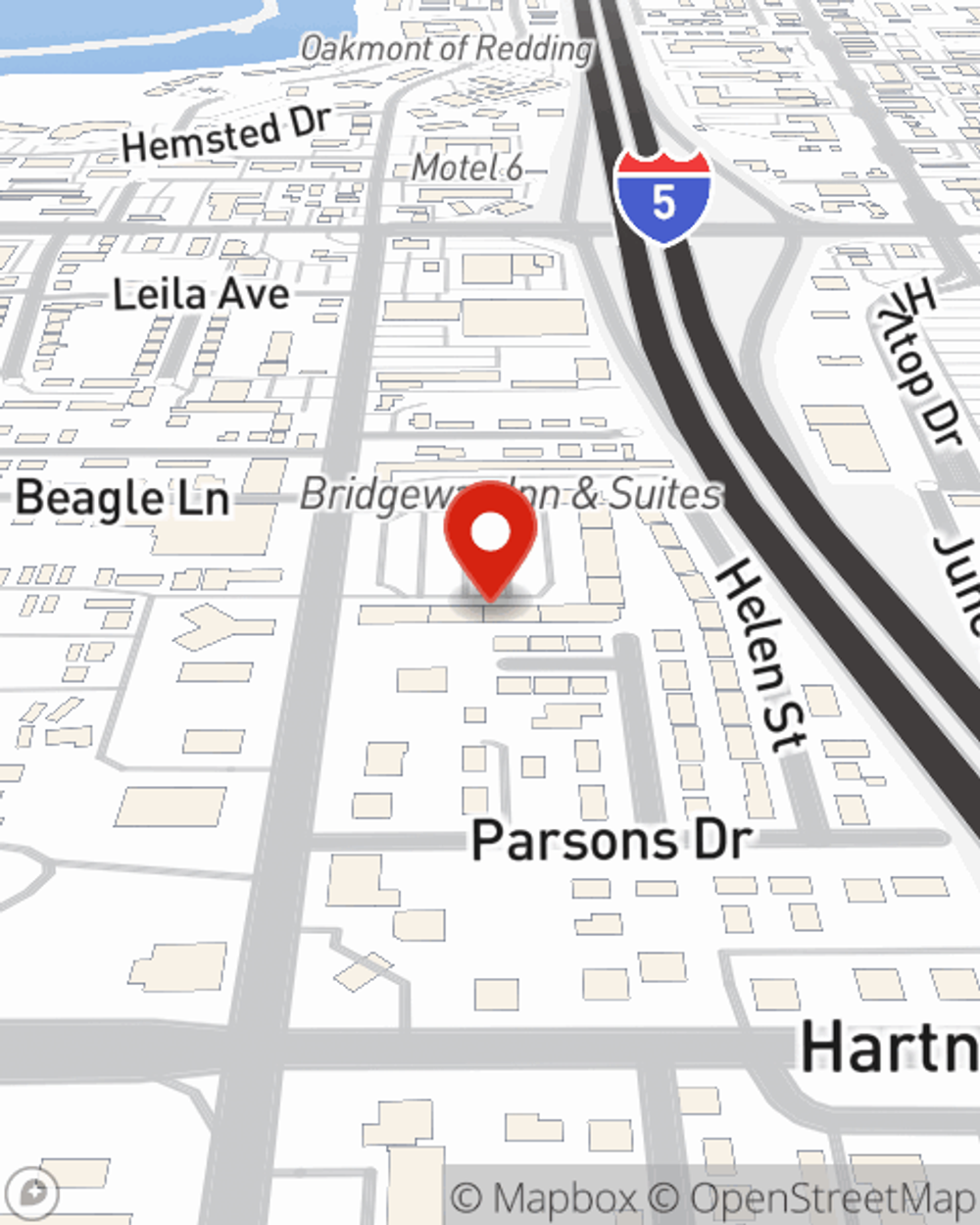

Business Insurance in and around Redding

Get your Redding business covered, right here!

Helping insure businesses can be the neighborly thing to do

Help Protect Your Business With State Farm.

Running a small business comes with a unique set of wins and losses. You shouldn't have to work through those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including extra liability coverage, worker's compensation for your employees and errors and omissions liability, among others.

Get your Redding business covered, right here!

Helping insure businesses can be the neighborly thing to do

Small Business Insurance You Can Count On

Whether you own a clock shop, a tailoring service or a lawn care service, State Farm is here to help. Aside from fantastic service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Get right down to business by calling or emailing agent Craig Winton's team to talk through your options.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Craig Winton

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".